To conserve money on automobile insurance policy, lots of families take into consideration signing up teens in secure driving programs or drivers ed courses. These programs are constructed to notify vehicle drivers when they are succeeding, in addition to where to make modifications to boost safety and security. A lot of insurer use price cuts to teenagers that finish these programs efficiently and show indications of secure, liable driving (cheapest auto insurance).

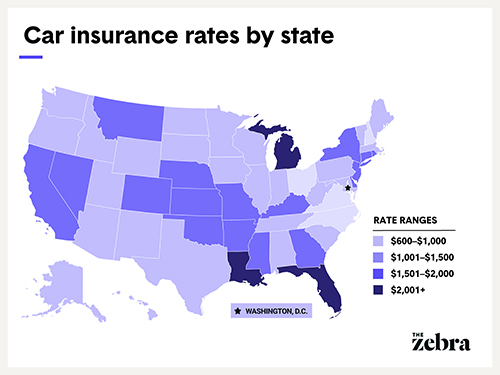

Utilize our tool listed below or call us at What Else Affects Your Car Insurance Coverage Price? In addition to age and driving background, right here are some other things that can affect typical vehicle insurance policy rates: Gender Location Marital standing Credit report rating Type of vehicle you're guaranteeing Security attributes on your lorry While many aspects like age and gender are out of your control, there are still lots of points that can certify you for lower rates.

On the other hand, foreign and deluxe autos are taken into consideration a high-risk for car insurance policy companies due to the fact that components are pricey. Many drivers see declines in cars and truck insurance rates after they obtain extra driving experience, prevent getting tickets, and prevent crashes.

All of it depends on the quantity of driving experience you have as well as exactly how long you keep a secure driving record. As an example, if you obtain your certificate right when you transform 16 and preserve a tidy driving document for a few years, you need to start to see reduced rates as soon as you reach your mid-20s.

cheap auto insurance insurance money cheap insurance

cheap auto insurance insurance money cheap insurance

This two-year driving background might not be long enough to verify to insurance provider that you have lowered your threat. To keep a tidy driving record, keep these secure driving pointers in mind: Limit the variety of other teen passengers and also distractions. Never ever drive with your phone in your hand or while consuming.

The 7-Minute Rule for What Can Raise Or Lower The Cost Of Your Car Insurance- Aaa

Make certain you're compliant in your city. Our Suggestions For Vehicle Insurance Coverage Despite your age, you ought to look around to locate the best car insurance coverage rates. Each business uses its own benefits and value, so it depends on you to choose what you require from your insurance policy provider. We assessed the top insurance policy carriers in the country to determine which is the best in consumer contentment, industry track record, price, insurance coverage alternatives, discounts, and also extra.

For many individuals, insurance coverage is seen as a complicated issue, especially when it pertains to car insurance policy for young people because they tend to pay the highest premiums of all motorists. One of the most critical concerns young individuals have on their minds relating to auto insurance is, "Does auto insurance coverage go down at 25?"Well, the short solution to this inquiry is of course - auto.

How a lot does auto insurance go down after turning 25? Annually of driving experience equates to decrease cars and truck insurance policy rates (automobile). The concept behind this strategy by insurance coverage companies is that once vehicle drivers transform 25, they have enough experience behind the wheel to make them much less of a liability; for this reason they are qualified to pay somewhat reduced costs.

credit score automobile affordable car insurance

credit score automobile affordable car insurance

If you are a 24-year-old, cars and truck insurance coverage will cost you usually 11% more than when you get to 25. car insured. You ought to additionally know that if you merely avoid any kind of unfavorable incidents while when driving and get no website traffic offenses till you are 25, you will remain in a much better position when it pertains to the automobile insurance coverage prices when you do transform 25.

When Does Cars And Truck Insurance Decrease? Are you still wondering, "Does cars and truck insurance coverage go down at 25"? It is good to know why as well as exactly how age affects car insurance policy prices as you obtain older. Enlightening oneself on the finer factors of auto insurance as well as the distinction that age makes in the quantity one has to pay will certainly guarantee that you will certainly take full benefit of the price cuts in vehicle insurance policy when the time is.

The Greatest Guide To Does Auto Insurance Go Down At 21? - 4autoinsurancequote ...

This is mainly because younger drivers are statistically more vulnerable to getting right into a crash while when driving. As a result of a high number of insurance claims, they cost the insurance firms much more money in home damages as well as medical costs. With time, young chauffeurs often tend to gain more experience behind the wheel, which results in the insurance costs gradually decreasing.

Some young chauffeurs who have actually already turned 25 will certainly not see any kind of changes at all in terms of their insurance premiums, in spite of the benefits that turning 25 years of age brings. insure. It is because they could fall into the complying with classifications: Unskilled Motorists No issue how old you are, your driving experience comes.

cars perks auto dui

cars perks auto dui

25-year-old drivers who simply got their chauffeur's license a year back are additionally going to be taken into consideration unskilled by the insurance coverage company. They will certainly pay greater premiums than a 25-year-old that obtained a permit at 15 as well as has been driving for a years - cheap car insurance. In both scenarios, the insurance firm is not mosting likely to take into consideration the age of the candidates but instead the years of driving experience they have.

This is great information for all women drivers available searching for a cut in their car insurance premiums. The void is not that vast when it comes to what male as well as female vehicle drivers have to pay prior to they turn 25. Contrasted to the difference that 18-year-old males and also 18-year-old ladies pay (11%), or even the difference between what 23-year-old males as well as 23-year-old ladies pay (6.

Females generally pay much less than males for vehicle insurance from age 16 to 26 because they're more careful in driving and less vulnerable to get in crashes (insurance affordable). Note that in specific states across the United States, it is taken into consideration illegal for vehicle insurance carriers to take into consideration the gender of the driver while determining the quantity of vehicle insurance premiums.

The Basic Principles Of What Can Raise Or Lower The Cost Of Your Car Insurance- Aaa

Here's a listing of the discounts that are available for 25-year-olds: A Telematics Program A telematics program has actually been developed to reward chauffeurs who drive securely - prices. Car Safety And Security Includes Does your automobile have certain safety and security functions, such as anti-lock brakes or daytime running lights? You can obtain an Find out more automobile insurance coverage price cut since of that.

The following are a few of the aspects noted by the car insurance service providers that may affect the quantity of costs that has to be spent for auto insurance policy: This is another significant element taken into consideration by the insurance policy carriers. For those living in The golden state, Massachusetts, or Hawaii, a lower credit score may boost your cars and truck insurance policy prices. auto insurance.

Experience If you have actually simply begun driving at 25 years old (or above) and also it is likewise your initial time buying auto insurance, you're mosting likely to wind up paying greater than a motorist who got the license at 16. ZIP Code Your zip code is additionally going to make a difference in the amount of vehicle insurance premiums you need to pay (credit).

In Conclusion, So, if you were asking yourself, "Does car insurance go down at 25?" You must be pleased to recognize after reading this post that your rates are most likely to reduce when you transform 25 years old. However, that will certainly work supplied you have a tidy driving record with no website traffic infractions or vehicle crashes.

It is most likely that your car insurance will go up after you have actually been in a crash. However, it will generally depend upon your circumstance since insurance coverage carriers consider each situation independently. What Is the most effective Vehicle Insurance Carrier? When it concerns cars and truck insurance coverage companies in the United States, the bright side is that there are a lot of options to select from.

Some Of Tips On Lowering Premiums - Missouri Department Of Insurance

cheap auto insurance perks credit cheap car

cheap auto insurance perks credit cheap car

Does Vehicle Insurance Coverage Drop at 25 Allstate? Yes. Presuming that you have a good driving document, as soon as you turn 25 years old, you can anticipate your premiums to go down. Yet then once again, it all relies on various other aspects that are thought about by Allstate insurance coverage. Does Your Auto Insurance Coverage Go Down at 25 Geico? Yes.

Does Your Insurance policy Decrease at 25 USAA? Yes. Insurance premiums tend to go down as soon as a person has actually reached the age of 25 merely due to the fact that USAA does not take into consideration 25-year-olds with a great driving record as high risk when it pertains to vehicle insurance coverage. vans. That stated, having an excellent credit report as well as staying in a low-risk location can additionally aid drive down premiums of auto insurance.

Generally of thumb, it is recommended to speak with your insurance coverage carrier prior to you authorize on the bottom line to make certain that you are obtaining the finest vehicle insurance policy prices in the area (cheapest).

In this short article: As a whole, more youthful vehicle drivers tend to pay more for car insurancebut when you get to the age of 25, the cost of your insurance plan can drop. According to , the average yearly costs for a 24-year-old male with full insurance coverage is $2,273. At age 25, that average drops to $1,989, a decline of about 12.

cheapest auto insurance accident perks automobile

cheapest auto insurance accident perks automobile

If you prepare to wait up until your policy renews, contact your insurer to see to it that you'll obtain a discount when it computes your price for the next policy period. Ways to Lower Vehicle Insurance Policy Expenses, While you can't control every one of the aspects that enter into your automobile insurance rateyour date of birth is established in rock, for instancethere are some that you can regulate (credit score).

The Single Strategy To Use For Car Insurance For New Drivers - Metromile

Keep in mind, each one will certainly evaluate various factors differently, and also some deal price cuts that others do not. It won't guarantee a lower rate, however it can assist. Some auto insurance provider offer optional coverage that's great to have, yet might not deserve the price (low cost). Look for secondary coverage that you don't truly need and could stand to cut.

Most insurers supply price cuts to consumers that buy numerous plans. You may be able to minimize your cars and truck insurance coverage by bundling it with renters insurance, house owners insurance, life insurance policy, motorcycle insurance policy or various other policy types. Some insurer provide a discount if you go to a defensive driving course, either online or in-person.

You'll additionally get real-time informs when adjustments are made to your credit record, such as brand-new accounts and queries. Checking your credit scores carefully will give you the information you need to develop as well as keep a great credit report.

From 30 to 64, auto insurance policy costs progressively reduce via the years, but, however, you will not get those major reductions as you saw at 25 - automobile. When vehicle drivers strike 30, they've had great deals of experience when driving and also age becomes much less of a variable in figuring out auto insurance premiums.

Teens are usually an obligation behind the wheel. Consequently, you might pay more for insurance policy if you are a teen chauffeur or have a young adult operating your automobile. Just How Can You Reduce Your Vehicle Insurance Coverage Price? Below are some ways you can decrease your car insurance policy rate: A crash or traffic offense will certainly trigger your rate to go up, so be a great motorist behind the wheel.

Does My Insurance Premium Go Down When I Pay Off My Car? Can Be Fun For Anyone

The only time many of us assume regarding our automobile insurance policy is when there is negative information, like a ticket or a crash. When you're young, single and incident-prone, rates only appear to go one method: up.