This is where the worth of your cars and truck can be a huge aspect. For that reason alone, you might see a huge cost jump in your costs if you go with the reduced deductible.

Yet if you're still favoring a greater insurance deductible, consider this: The length of time would certainly it take to redeem what you'll invest in premium costs? If it's just going to take you a year or more, the higher deductible may still be looking great (dui). Otherwise, the reduced insurance deductible may make more sense.

Consider how you use your cars and truck. Where do you live? Where do you drive to? Where do you park? If you reside in a peaceful community with a short commute to function, you may be comfortable with a higher deductible. In the end, it's your phone call - affordable. Make certain as well as talk to your ERIE representative to help you establish which strategy is right for you.

An auto insurance policy deductible is one of the most important elements to take into consideration when choosing protection for your car. accident. Because your deductible will impact your monthly premium as well as the amount you'll pay for problems after making an insurance claim, it's important you choose carefully.

The Auto Insurance Deductible - Rogersgray Statements

If your problems surpass your deductible, the insurance policy firm will cover the remaining balance up to your insurance coverage amount., and also are called for to pay up to the insurance deductible quantity prior to your insurance policy firm steps in to cover the rest.

There are 2 primary sorts of vehicle insurance coverage coverages that typically include deductibles:: This coverage aids spend for damage to your lorry if it strikes one more cars and truck or item, is struck by an additional vehicle, or rolls over.: This protection assists pay for problems to your automobile that are not brought on by a crash. insurance.

If you have a $500 deductible and the damages to your cars and truck complete $450, you would certainly pay the full $450 - accident. If the problems to your cars and truck total $1,000, you would pay your $500 deductible, as well as the insurance business would certainly cover the staying $500. When Do You Have to Pay A Deductible? You just pay a deductible when there are protected damages to your lorry, not when there are problems to one more person's car.

If a driver strikes your automobile as well as both you and the other driver are identified to be at mistake, then you might be responsible for paying at least a section of your deductible if you file a case with your own insurance policy company. You struck one more motorist's cars and truck. If you strike another person's lorry and also in doing so, harm your car, your insurance coverage business typically will pay for the problems to your cars and truck, as well as you will be liable for paying the insurance deductible.

The Buzz on Basics Of Auto Insurance - Mass.gov

Depending on your policy, you may need to pay an insurance deductible. Again, contact your insurance policy agent to verify what your insurance coverage will do. Your lorry was damaged in a hit-and-run. If you have crash or uninsured/underinsured driver protection and also somebody hits your vehicle as well as leaves the scene, you likely will be in charge of paying your insurance deductible.

Generally, the a lot more pricey your car, the extra it sets you back to insure. That can equate into higher cost savings if you select a high deductible. A number of factors impact the price of your car insurance plan, yet your insurance deductible will certainly have an influence on your premiums in addition to on just how much you'll pay out-of-pocket for damages to your automobile from an accident.

With any luck you might never ever deal with a situation where you'll need to pay a deductible, however it is essential that you take care to select a policy with an insurance deductible that you can pay for to pay. Your insurance representative can help you address your deductible inquiries. Call Vacationers for your car insurance coverage quote.

The cash we make assists us offer you accessibility to totally free credit history as well as reports and also assists us create our various other wonderful tools as well as educational materials. Compensation might factor right into how as well as where products appear on our platform (and also in what order). But since we generally earn money when you find an offer you such as and also obtain, we try to show you supplies we assume are a good match for you.

The Main Principles Of Comprehensive Coverage - Auto Insurance

Confused about how a vehicle insurance coverage deductible works?, you'll likely come throughout the word "insurance deductible" as well as might question just how it influences you and also your insurance coverage costs and when you'll actually require to use it.

Usual vehicle insurance coverage deductible quantities are $250, $500 and $1,000. Fixings amounted to $5,000, as well as you have a $500 insurance deductible (cheapest car insurance).

An automobile insurance deductible isn't a single amount that you pay each year before services are covered, like you'll generally find with health and wellness insurance deductibles. In other words, it depends on where you live - car. In most states, if you're in a crash that's the other motorist's mistake, their responsibility insurance coverage is typically accountable for covering your repair services, as much as the insurance coverage restriction.

What is a car insurance policy deductible? The insurance deductible is the dollar amount "deducted" from an insured loss.

What Does Auto Insurance To Help Protect You - Uber Mean?

1 For numerous customers, establishing simply exactly how much of an insurance deductible to take can be a tough decision. Exactly how does a cars and truck insurance coverage deductible work?, although they might be the same deductible amount.

Comprehensive insurance coverage secures your vehicle from burglary and also damages not brought on by a crash. The deductible on your policy will apply if you file a claim for damage covered by comprehensive, nonetheless there are some circumstances in which you do not need to pay an extensive insurance deductible. As an example, fractures or chips in your windscreen may be paid completely by your insurer relying on the state you stay in. cheaper cars.

Any type of claim you apply for damage that is covered by collision will be subject to a crash insurance deductible (cheaper car). 1 The greater an insurance deductible, the lower the yearly, biannual or regular monthly insurance policy premiums might be since the customer is presuming a portion of the overall cost of a claim. Bear in mind that the insurance deductible amount will certainly come out of the insurance holder's pocket in case of an at-fault auto mishap, which might eclipse the premium financial savings.

laws insurers trucks cheap insurance

laws insurers trucks cheap insurance

insured car vans cheaper car affordable

insured car vans cheaper car affordable

If the insurance holder does not have an at-fault mishap resulting in an insurance claim, the individual has actually paid even more for auto insurance policy than somebody with a higher insurance deductible. When do you pay the insurance deductible for car insurance coverage?

Excitement About Michigan's Auto Insurance Law Has Changed

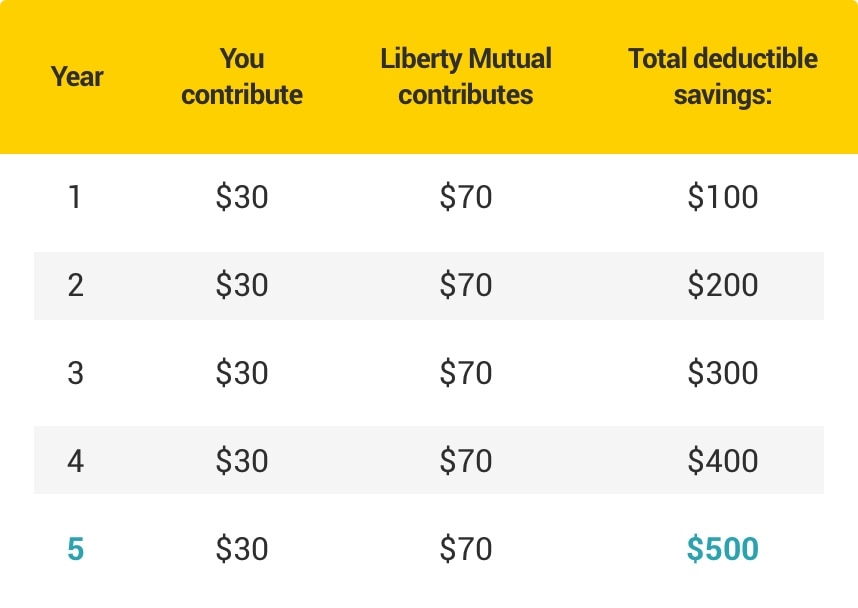

This is only the instance as long as the expenses drop within the range of the coverage you acquired. Lastly, a reducing deductible might inevitably lead to a lowered deductible or perhaps none whatsoever. This kind of deductible rewards drivers for preventing crashes by lowering their deductible yearly they remain accident-free.

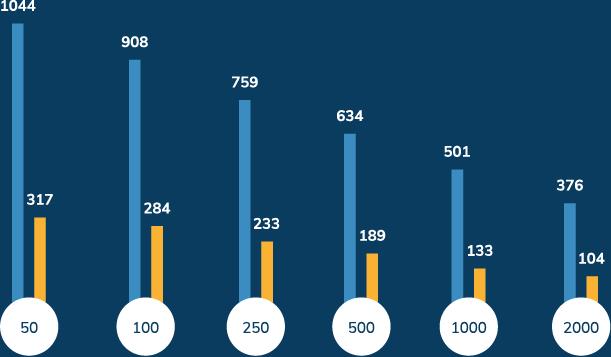

A high insurance deductible will reduce your general insurance rate, nonetheless it will certainly boost your out-of-pocket prices if you file a claim. 1 Five questions to help you select the appropriate automobile insurance deductible In establishing the right deductibles, here are 5 inquiries to think about before deciding: How do various insurance deductible levels influence the insurance coverage costs? This is an excellent concern as no 2 insurer will certainly have the very same deductible-premium proportion, and also states differ on their governing strategy to the subject - cheaper.

That $800 currently appears of the proprietor's wallet - vehicle insurance. Nonetheless, if the proprietor had a $100 insurance deductible, the out-of-pocket cost would be only $100, offering a cost savings of $700. Is it better financially to have a low deductible and a higher premium? That depends. Someone with a low deductible/higher premium proportion can experience a 10-year duration without submitting an insurance coverage case.

cheaper car insurers insure insurance company

cheaper car insurers insure insurance company

How does an individual's driving document affect the selection of deductible? The existing reasoning is the cleaner the driving record, the better the consideration one should provide to a greater insurance deductible as it will certainly decrease costs. On the various other hand, for someone with a less-than-clean driving record, the person must take into consideration taking a reduced deductible, regardless of the added costs. risks.

The Facts About What Exactly Is An Auto Insurance Deductible? Uncovered

For some, it can be a little bit frustrating. Allow's clarify exactly how deductibles function as well as how to select the best one for your budget plan and insurance coverage demands. Simply put, a deductible is the amount of cash you'll have to contribute towards clearing up an insurance policy claim. It works similarly despite your degree of insurance coverage and is most commonly included in comprehensive and also accident bundles.

Uncommon, there are some exceptions where an insurance deductible is non-applicable. If another guaranteed motorist is liable for your problems as well as injuries, a deductible does not use.

But for new automobile owners, the outlook may not be as glowing. The average expense of a brand-new lorry is estimated to be $37,000, which results in higher costs. If you drive a new auto and also are involved in a major accident, it can trigger thousands in damages (not to mention the potential for personal injury) or amount to the automobile - cheaper car.

/Understanding-What-is-a-Deductible-in-Insurance-Women-Explaining-58900c523df78caebc6ea56b.jpg) low cost cars cheaper insurance company

low cost cars cheaper insurance company

For motorists with a high deductible, the majority of the repair work expenses would fall on them. Stacking Insurance deductible, Before signing on the dotted line for your policy, you need to confirm exactly how each circumstance is dealt with.

Getting My Comprehensive Coverage - Auto Insurance To Work

cheapest cheaper cars auto insurance low-cost auto insurance

cheapest cheaper cars auto insurance low-cost auto insurance

Nonetheless, your deductible is evaluated $1000, and also the agreement states it is used individually. This means you 'd need to add toward auto fixings and also the clinical expenses of every traveler - insurance company. Because of this, always ensure your deductible is https://car-insurance-elgin-il.eu-central-1.linodeobjects.com bundled in as many stipulations as feasible to prevent scenarios of this nature.